Risk profiles of insured properties evolve over time and it can be challenging for property and casualty insurers to update policies to keep pace with normal year-to-year changes. Climate change adds a substantial wrinkle to the equation by increasing the frequency and impact of natural disasters. Access to visual data will be critical for P&C underwriters and adjusters to help their customers recover quickly from disasters, as well as to mitigate and adapt to future impacts of climate change. The future viability of insurers will hinge upon how they handle the challenges posed by climate change and an evolving environment. Challenges include:

- Rising sea levels threaten major coastal cities. Municipalities, such as Miami, are undertaking large-scale infrastructure projects just to remain livable. This means insurers need better and more current data about flood risk, so that they can develop models to help with loss prevention.

- Non-coastal areas are facing other adverse climate effects. Droughts have affected the Far West, the Northeast, and the Chicago area while flood-inducing rains have done significant damage in Southern California, Eastern Kentucky, and Northern Texas. Barge traffic on the Mississippi has been impeded by low river levels. Some zip codes have become hard to insure, as droughts and lower soil moisture, combined with higher temperatures, have created areas that are newly prone to wildfires. And erratic weather patterns have led crop insurers to seek better data on soil health and moisture content.

- Populations are shifting rapidly. Some cities are shrinking while some are growing rapidly, meaning residential patterns are changing. More people are living full-time in what were once “vacation” sites, and thanks to new communications technologies, many people are now living and working in what had been remote locations. Consequently, insurers will find it harder to map and model urban areas without better data sources and more frequent updating.

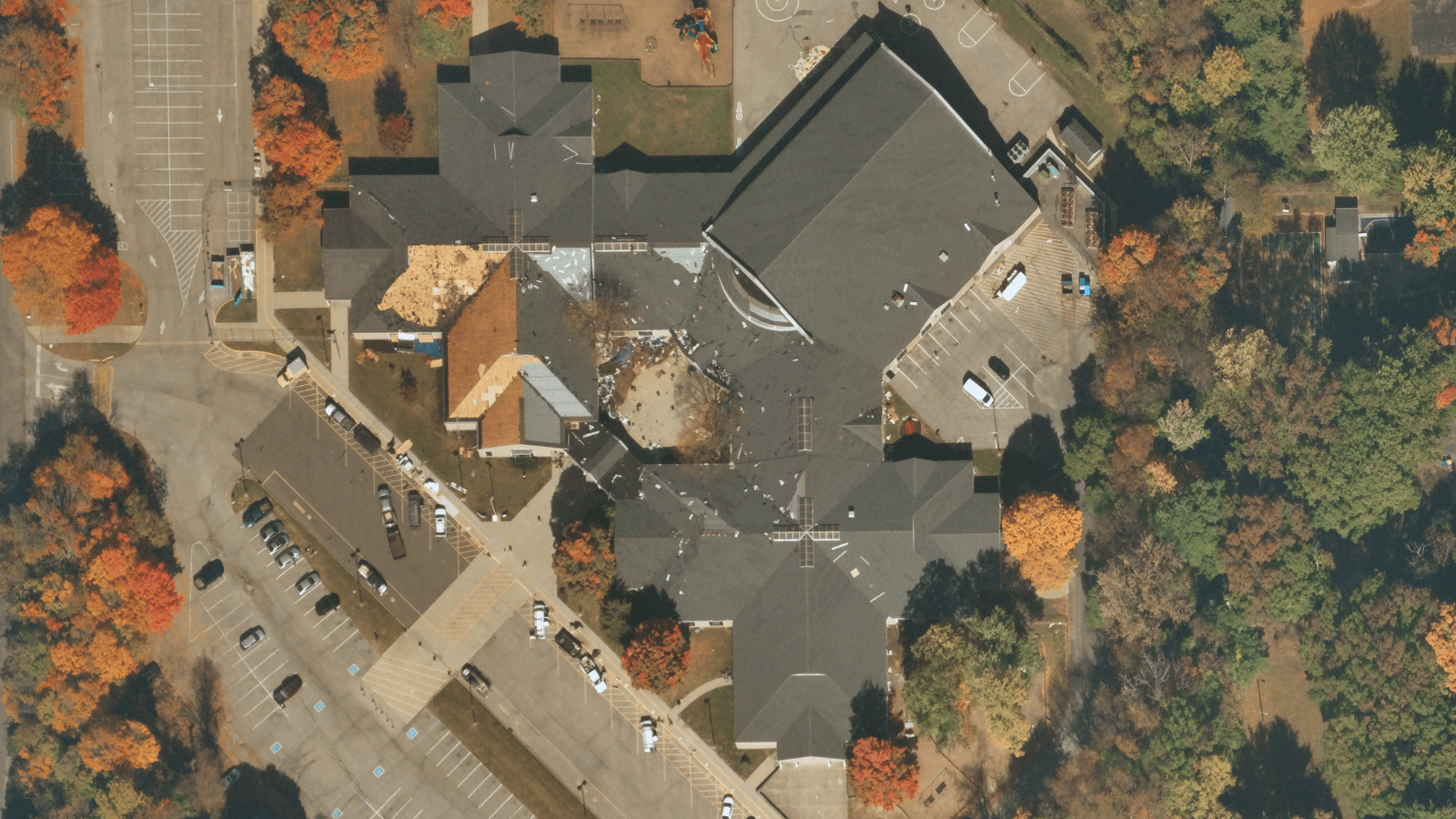

The hurdle now is in getting the right imagery, with the right degree of resolution, on a timely basis. This imagery can help insurers respond more quickly and effectively to disasters, but it can also help them advise customers on how to keep small problems from becoming large ones. One example: spotting and replacing missing roof tiles before a weather event can head off many thousands of dollars in additional damage.

Near Space Labs 10 cm image of building undergoing roof replacement due to missing shingles.

When a catastrophic event takes place, imagery can also help insurers authenticate and accelerate claims by providing detailed insights at scale about property portfolios. High-quality, frequently refreshed imagery provides data that enables insurers to easily compare pre- and post-catastrophe conditions, which saves insurance carriers time and money and dramatically improves the overall customer experience.

Carriers are also powering their models with imaging data to inform decisions about what “could be” – whether that’s mapping potential floods or understanding where wildfire risks are with up-to-date perimeter data and input such as vegetation buffer zone assessments. With this kind of input, the feedback loop between claims and underwriting becomes stronger. Underwriters have more recent and more accurate data upon which to base their decisions. They can mitigate risk more accurately, set appropriate pricing, and help reduce future losses. And they can do this at scale, for portfolios of properties spanning not just urban areas but rural and remote areas as well.

This has major implications for not just claims but the entire customer relationship. With earth observation and analysis significantly reducing in-person inspections, claims can be assessed and paid quickly, increasing customer satisfaction and retention while reducing operating costs. And, when insurers have access to frequently refreshed images of the “before” as well as the “after” of an event, the opportunities for fraud in the wake of a weather-related event also decrease dramatically.

There are several different approaches to collecting imagery. For example, our zero-emission, autonomous Swifty robots fly to the edge of space via weather balloons to collect and distribute high-resolution, high-frequency data about our planet. Other methodologies include drones (which provide high resolution, but lack the ability to easily scale;) satellites (which provide wide coverage, but lack high-quality resolution;) and fixed-wing aircraft (which tend to capture imagery of a small area at a lower frequency.) Since decisions about underwriting, renewals, and claims are only as good as the data that’s available, it’s critical that carriers use the most updated, refreshed, and high-quality imagery possible.

According to McKinsey, one of the biggest changes in claims over the next 10 years will be the shift away from claims handling to claims prevention and mitigation. We believe that earth imaging will play an important role in this shift. Our technology is already helping insurers assess the conditions of the properties they cover and determine the extent of damage incurred as the result of events such as storms and wildfires. We envision a world in which insurers reach out proactively to policyholders with data-driven suggestions on ways to avoid loss; for example, customers may receive notifications to remove cars in locations that might be affected by floods.

The next phase of evolution for claims will be the incorporation of better data – not only from innovative imaging but from other emerging sources – into ever-more sophisticated analytical models that guide not only how properties should be underwritten but provide direction into where and how properties should be built. With this kind of data, claims can help society respond to the challenges posed by climate change and ease the movement to a sustainable, ecologically friendly future.