What does full data coverage mean for insurers? In this blog, we’ll uncover why “full coverage” means more than just the availability of data and why carriers should look to re-evaluate the quality of imagery they use to base decisions.

Definition of Full Coverage

We define, and challenge carriers to redefine the definition of full coverage, as “the availability of frequently updated and recent property data in all locations of operation.”

How this differs from traditional definitions is the added component of recency and frequency. For instance, does 100% coverage of properties once a year equal full coverage? What about twice a year?

We’ve found the coverage sweet spot for insurers is quarterly refresh rates to account for seasonalities and the many changes that can occur throughout the year, across all policy locations. This amount of data is also easily digestible and maintainable to be used effectively throughout current and new processes.

Without access to highly refreshed, recent imagery data, carriers may be basing decisions using outdated information that directly impacts risk, losses, and ROI. Full coverage can no longer mean 100% of policy locations are covered. We must not forget about the importance of recent data to truly represent full coverage.

Pain Points for Carriers

When it comes to the quality and availability of imagery that carriers work with (with high-resolution being a standard), we find there are two main pain points:

- Lacking geographic coverage of certain policy areas

- If there is coverage, the data being outdated (or not frequent enough)

These challenges can create an influx of inherent and unknown risk to property portfolios. Let’s walk through a few examples of why full coverage is critical in each stage of the policy life cycle.

Underwriting

At the point of sale, an underwriter writes a quote that reflects the amount of risk the carrier agrees to take on and covers the policyholder up to a certain amount in the case of a claim. If the data that’s used to base this decision is outdated, an inaccurate risk assessment is likely which could lead to a multitude of problems including underinsured customers, increased portfolio risk, and even lost sales.

For example, an underwriting model uses data from six months ago to base its quote amount. Four months ago, the homeowner built a shed in their backyard which is unrecorded in the six-month old data. If the policy is accepted by the customer, they now face underinsurance and the risk of paying out of pocket when the unexpected happens. And even if the shed is identified after the policy is won, the carrier may be unable or unwilling to adjust the premium, both leading to a poor customer experience.

Let’s think about the reverse. The homeowner removes a shed from their backyard four months ago, and the six-month old data includes the shed to provide the quote. The policy amount could be much higher than the actual risk of the property, causing the homeowner to look elsewhere for better rates, and diminishing potential sales.

With imagery refreshed quarterly, or every 90 days, underwriters have the most up-to-date information to base the policy and quote. By understanding the true risk of properties, underwriters can write more accurate and competitive policies to drive sales, ensure customers are correctly covered to increase satisfaction, and improve overall risk mitigation.

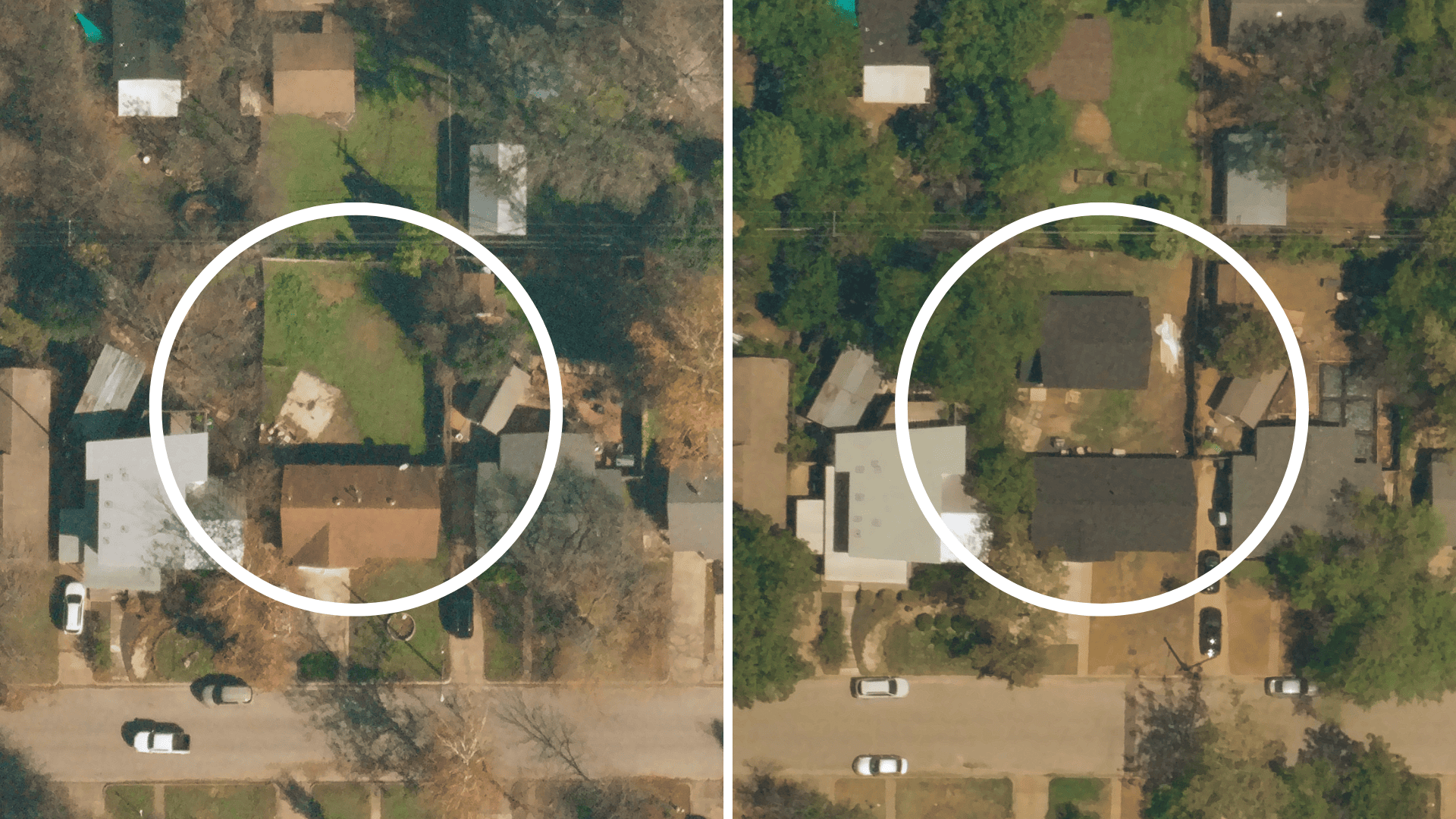

Near Space Labs’ high-frequency captures of a property with an updated roof and an addition of an unattached structure in the backyard.

Renewals

While renewal cycles are typically a year long, data that is a year old or even six months old won’t cut it. Whether it’s renovations, additions, or unfixed damages, changes are occurring constantly throughout the year and can drastically affect the risk profile of a property.

For example, in 2023, 61% of home insurance policyholders in the US are planning renovations, but 34% don’t plan on reporting this to their insurance provider, according to the Hanover 2023 Home Renovation Report. Not only does this create an imbalance of coverage that could lead to uninsured losses, but it also decreases the opportunities for underwriters to uplevel policies if outdated data is used.

Gathering property data during renewal periods can happen in a few ways – outsourcing imagery from companies like Near Space Labs, operating in-house drone teams, or sending inspectors on foot. The current challenge with on-site inspectors as well as drone teams, due to their limited range capabilities and need for an on-site operator, is that it takes ample time and resources to inspect all policies. This leaves room for data to be captured too far in advance of the renewal period, leading to inaccurate policy updates and/or an increase in portfolio risk. And to top it off, insurers are finding up to 75% of these on-site inspections are wasted due to a lack of change to the property, and therefore no updates to the policy.

Near Space Labs works to compliment in-house drone teams and on-site inspectors by triaging inspections with timely and highly recent imagery. No later than 90 days before the renewal date, we cover the entirety of insured properties helping underwriters identify where changes are occurring so they know exactly where to send their teams. By supplementing drone teams and inspectors with our solution, imagery can be collected in a much shorter time frame and as close to the renewal date as possible.

Whether insurers are using an in-house drone team or outsourcing imagery, the age of the imagery should be a top priority. With highly-recent property data, carriers can now accurately adjust renewal policies to represent the true risk of properties, maximize inspection efficiency, and fully capitalize on potential revenue.

Near Space Labs’ high-resolution captures showing a property upgrading to a more resilient, metal roof with the addition of solar panels, revealing a change in risk to a policy.

Claims

The primary purpose of someone purchasing homeowners insurance is to protect themself from financial losses in the case of a property claim. It’s important to keep customers happy at this stage of the policy lifecycle to retain loyalty and remain competitive. According to Accenture, approximately 30% of dissatisfied claimants revealed they switched carriers within the past two years and 47% said that they were considering switching due to a poor claims experience, leaving up to $170 billion in premium at risk over the next five years.

Full coverage of policies not only helps carriers accelerate the claims process to improve customer experience and reduce churn, it also helps improve the accuracy of assessments, prevent fraud, and reduce litigation and expenses.

Similar to renewals, we help carriers triage claims assessments by identifying properties that require a more in depth evaluation, across all policies in force. In the case of a full loss, carriers can immediately begin the settlement process and pay customers without the need for an on-site visit, speeding claims to settlement times. In turn, assessors reduce unnecessary trips and can quickly and efficiently focus their attention on partial loss cases that need additional attention.

Highly recent imagery also supports insurers efforts to minimize fraud, which accounts for about 10% of P&C losses, and reduce litigation costs, by authenticating claims and improving the accuracy of damage assessments. With access to imagery 90 days before and after a claim is made, verifying claims can happen quickly and easily. Insurers are able to see if a property was damaged prior to the claim and provide proof of the property’s condition if they suspect fraud.

In turn, with an improvement in damage assessment accuracy, payout amounts also become more accurate. This helps prevent overpayment, but also underpayment which directly relates to litigation costs. Furthermore, with continued coverage of all insured properties, carriers can record and monitor if damages are not being repaired and step in to offer additional support, including further financial assistance and/or risk mitigation recommendations to reduce future losses.

Full coverage for claims teams means they can respond to more claims faster, helping customers get back on their feet as quickly as possible, whilst improving efficiency, reducing fraud, and decreasing expenses.

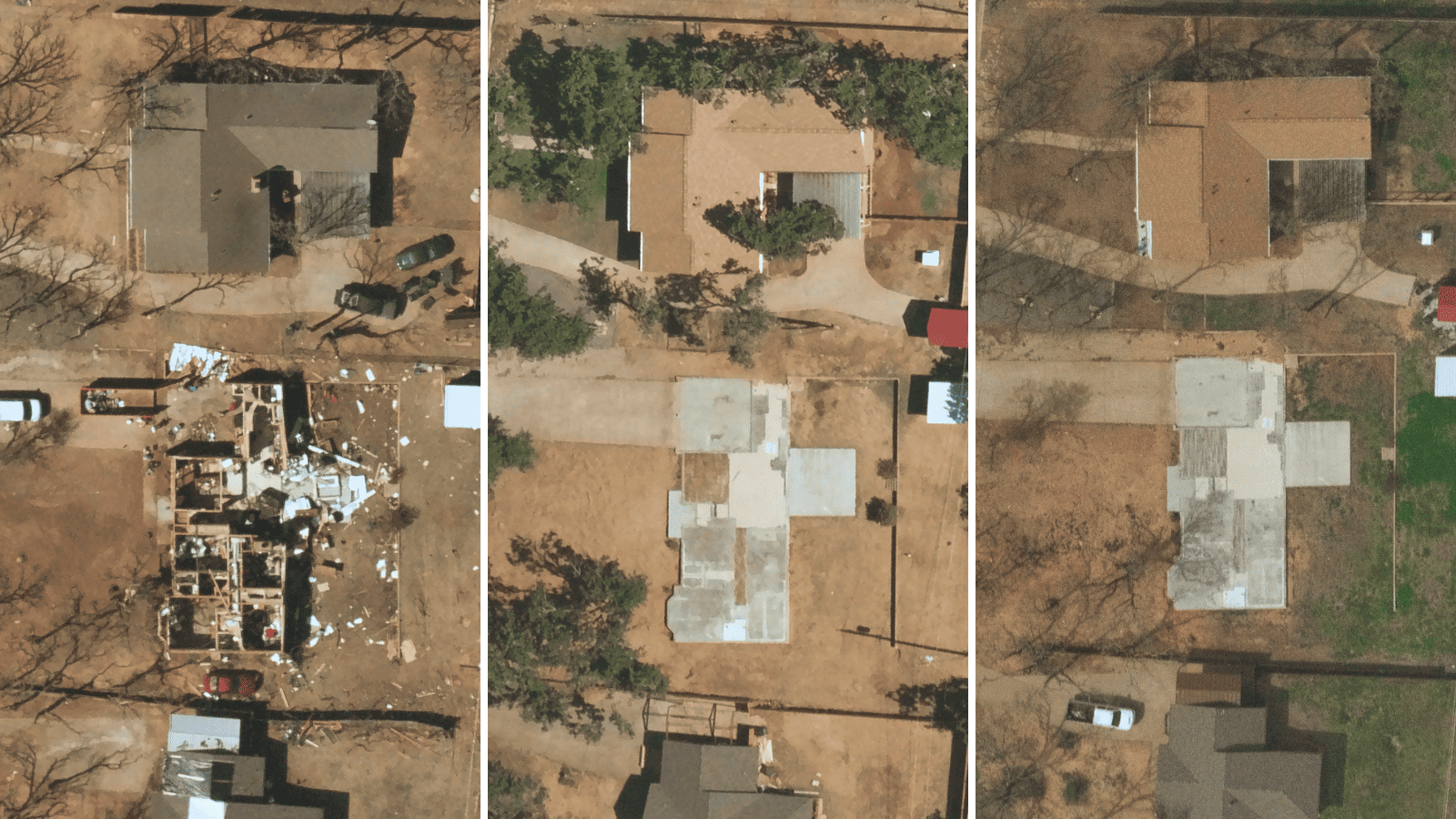

Our frequent captures showing the halted recovery progress of a full loss claim one year after the property was damaged.

Knowing what you know now, do you have full imagery coverage?

Without understanding the importance of pairing the age of data with full location coverage, it can be easy to think your team may already have full coverage. But do you?

Near Space Labs offers 100% coverage of US locations every 90 days including policies in urban, rural, and remote locations. With our data, insurers are becoming more competitive in locations where they don’t currently have any imagery coverage, as well as in the areas where coverage is outdated. Integrating the highest-quality data available is empowering more confident and accurate decisions across the policy lifecycle, helping carriers mitigate risk, reduce losses, and build stronger relationships with policyholders.

If you’re a carrier looking to expand coverage whether it’s geographically or the recency of your imagery, get in touch with our team to schedule a call.