Near Space Labs for Insurance

Empower confident decisions and build stronger relationships with policyholders with highly accurate property data, powered by zero-emission technology.

Drive Accuracy and Responsiveness throughout the Policy Life Cycle

Underwriting

Post-Catastrophe

PostCAT40

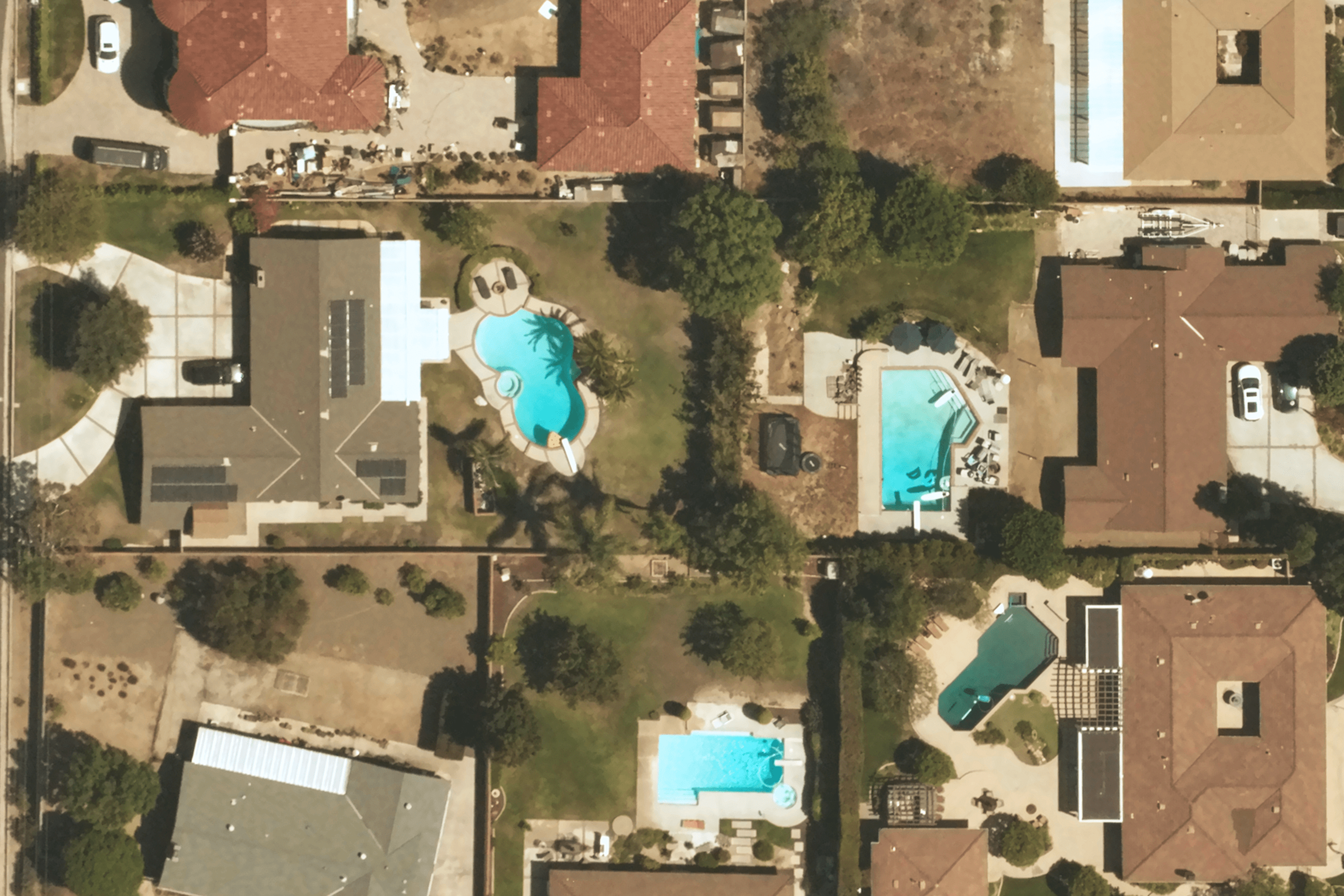

Imagery Without Tradeoffs

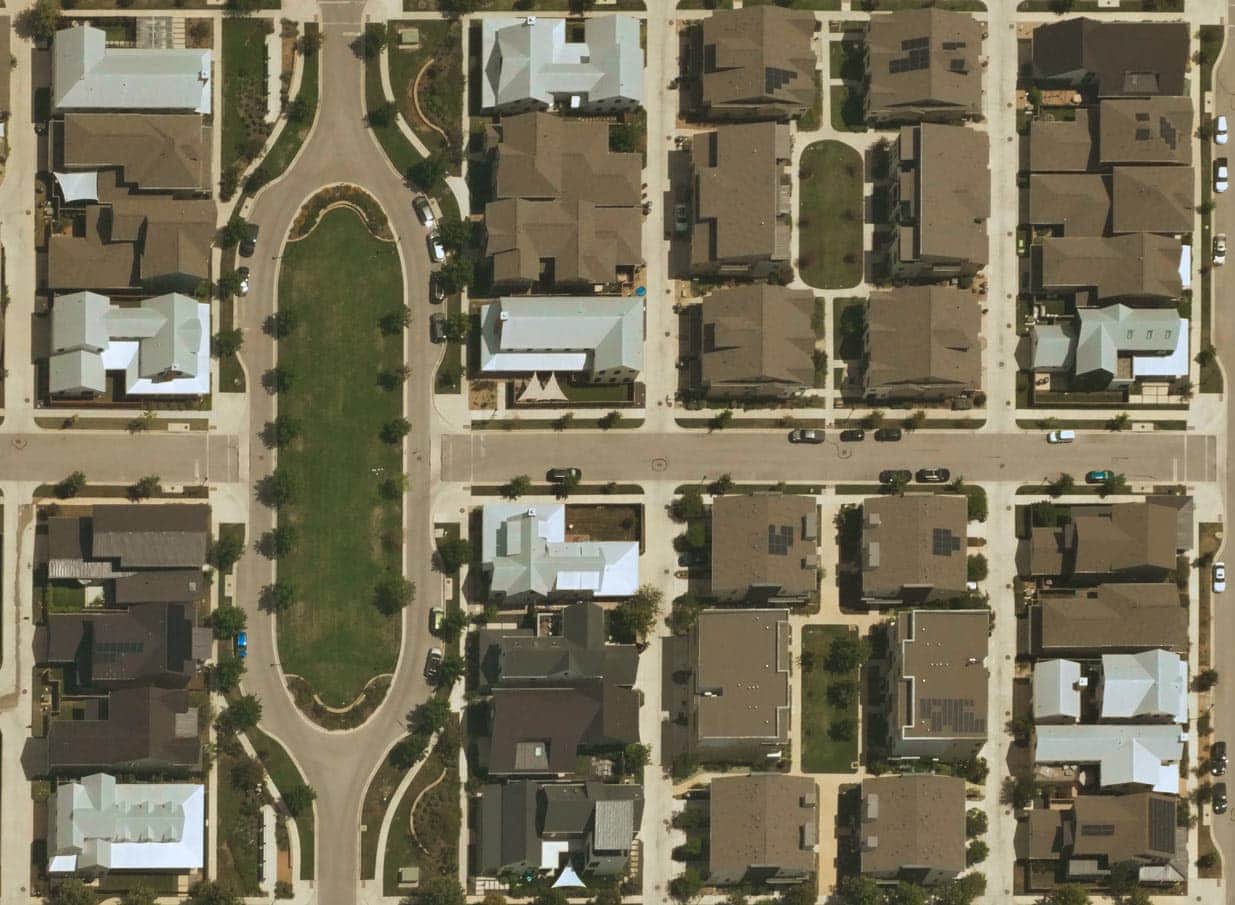

Wide-Scale Captures

Time Sensitive

Ultra High-Resolution

Zero-Emissions

See how insurers are using our imagery

Build a Source of Truth, to Accelerate and Authenticate Claims Pre- and Post-Cat

Current challenge

- Customers are switching carriers at an alarming rate due to poor claims experiences, leaving $170 billion in premium at risk over the next 5 years, according to Accenture. Furthermore, research indicates that fraud occurs in about 10% of property-casualty insurance losses, amounting to a staggering $45 billion annually. Carriers need a solution that will allow them to validate damages, reduce expenses, and accelerate the claims process to improve customer satisfaction and reduce churn.

Our solution:

- With Near Space Labs’ pre- and post-cat imagery, carriers are validating and accelerating claims, whilst reducing litigation and expenses. With timely post-cat imagery, assessors can remotely determine the extent of damage, triage inspections to partial loss cases and immediately get paychecks to customers in the case of a full loss without the need for an on-site visit. By improving operational efficiency, costs are reduced and the customer experience improves.

Improve Risk Assessment

Current challenge

- Outdated data leads to inaccurate risk assessments which can result in carriers pricing policies incorrectly, adding increased risk to their portfolio and leaving the policyholder underinsured. In order to avoid these negative consequences, it is essential for carriers to prioritize the use of up-to-date data in their quotation processes.

Our solution:

- With Near Space Labs’ highly recent imagery, carriers capture true risks, leading to more accurate and competitive policy quotations. Plus, carriers are able to drive the policies they want, de-risk the portfolio and improve the customer experience.

Take Preventative Actions to Mitigate Risk and Prevent Future Losses

Current challenge

- The US insurance industry is facing significant challenges, with reports stating carriers collectively losing $480 billion in 2021, representing a loss ratio of over 60%. And due to climate change, natural disasters have significantly increased causing more severe and frequent damages to properties, and thus, more claims. Insurers need a solution that allows them to keep up with the pace of change, reduce losses, and prepare for future catastrophic events to come.

Our solution:

- With the most recent property data available, carriers are proactively identifying risks to properties and taking preventative actions to mitigate risk and avoid potential claims losses. For example, a carrier may inform a policyholder of missing shingles on their roof and help them fix the damages before it becomes worse. Using our highly refreshed imagery, carriers can identify and proactively mitigate current risks to policies and help save their customers as well as themselves from future catastrophic losses.

Near Space Labs Surveys for Secondary Perils

Up to 70% of insured losses now attributed to severe thunderstorms

Additional Resources

Near Space Labs’ High-Quality Imagery Helps Insurers Deal with a Rapidly Changing World

Risk profiles of insured properties evolve over time and it can be challenging for property and casualty insurers to update policies…

Near Space Labs Partners with Tensorflight to Provide Highly Accurate Geospatial Intelligence to Insurers

We are thrilled to announce we have joined forces with Tensorflight…

Better imagery helps insurers handle rapidly changing claims

The startup flies autonomous craft in the stratosphere to deliver much more high-resolution image data in hours rather than days or weeks.

Near Space Labs’ Imagery Helps P&C Insurers Refine Underwriting and Accelerate Claims

Property and casualty insurance companies with large portfolios of residential and/or commercial buildings face challenges…

Near Space Labs Speeds Accurate Property Imaging from the Stratosphere

The startup flies autonomous craft in the stratosphere to deliver much more high-resolution image data in hours rather than days or weeks.

Near Space Labs’ High-Frequency, High-Resolution Imagery for Insurance Renewals

Review highly updated property imagery to make more efficient and profitable updates to renewals policies…

Why insurers are looking to near space imagery

When it comes to insuring real property, P&C companies have a problem. It is essential for insurers to have up to date information…

Near Space Labs’ High-Frequency, High-Resolution Imagery for Insurance Claims Processing

Validate claims and assess property conditions with historical stratospheric geospatial data for more accurate and efficient claims processing…