Climate disasters are on the rise, and their devastating impacts are being felt worldwide. From extreme weather events like hurricanes, floods, and wildfires to rising sea levels and heatwaves, our planet is facing unprecedented challenges.

Insurers are at the forefront of businesses affected by climate change, serving as vital financial protectors in times of disaster, and with the increase in number and intensity of natural disasters, they are facing immense pressure to keep up with evolving risks. We are already seeing top carriers like State Farm halt new policy coverage in California due to the state becoming too high-risk to be responsibly insured, and the P&C industry as a whole reaching record high personal lines loss ratios at 74.8% in the first quarter of 2023. This isn’t sustainable, calling for actionable climate change adaptation and proactive risk mitigation strategies to be put in place…yesterday.

Although they aren’t alone, insurers have a responsibility and the power to proactively mitigate climate-related risks and build resilience to climate change through improved predictability models, consumer incentive programs, and high-quality, sustainable data and partnerships.

Identifying high-risk areas to prioritize risk mitigation efforts:

Before risk mitigation practices can be implemented, it’s important to first understand which areas should be prioritized so resources can be allocated effectively and efforts aren’t wasted. This can be done through advanced data analysis, predictive modeling, and collaborating with other organizations and entities such as local governments and emergency service groups. Using historical data of weather events and property damage, carriers can map out low-, medium-, and high-risk areas by identifying which regions endured a higher frequency or severity of natural disasters. These comprehensive assessments also combine factors like vulnerability of infrastructures, exposure to hazards, and potential economic impact to determine which areas are in greater need of proactive risk mitigation initiatives.

Implementing risk mitigation practices to reduce losses in the face to climate change:

Once the priority areas are identified, an in-depth risk assessment can be conducted to identify and notify customers of current vulnerabilities, including damaged properties, aging infrastructure, vegetation encroachment, and unmaintained buffer zones. With this knowledge, carriers have the opportunity to implement consumer incentive programs to help reduce risk exposure and safeguard their customers, and themselves, from potential future claims losses.

Near Space Labs’ imagery showcasing tree overhang, a fire safety hazard in Los Angeles, CAL Fire Southern Region, California.

Incentive programs can come in two forms, negative and positive reinforcement. Negative reinforcement involves raising premiums if a policyholder doesn’t take measures to maintain a well conditioned property or fix repairs when carriers make them aware of the issue. Positive reinforcements involves lowering premiums, reducing deductibles, or offering additional coverage options at no additional cost to customers who proactively harden their homes resilience with actions including:

- installing storm shutters;

- maintaining a defensible space away from their property by removing dry brush from the area;

- choosing fire-resistant plants;

- anchoring heavy furniture and fixtures in seismic zones and;

- regularly maintaining drainage systems to redirect water away from the foundation of homes or businesses.

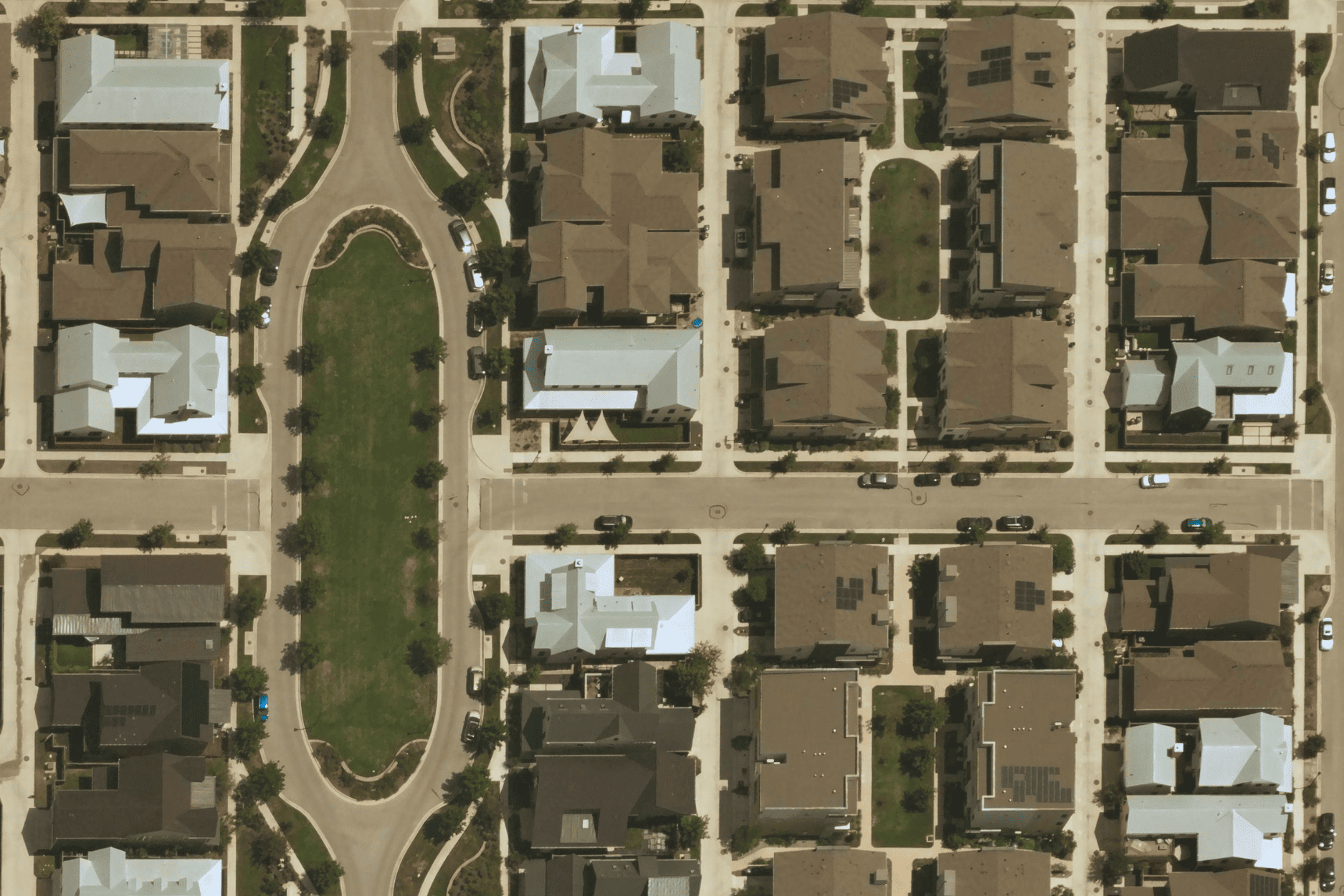

Example of a neighborhood upgrading to more resilient metal roofs to prevent potential damages from weather events in Austin, Texas.

These incentive programs are no longer just an option, they are an essential component in building more durable communities to mitigate the effects of climate change. The question here is… how much are carriers willing to invest in incentive programs to offset and reduce more costly future losses?

Securing sustainable data and partnerships to make proactive risk mitigation possible:

In order for carriers to identify high-risk areas, pin-point properties that require attention, and accurately implement consumer incentive programs, they need the right support from imagery providers and partnerships. Without highly accurate data sources, risk assessments scores may be skewed leading to inefficient resource allocation, and an increased risk for potential losses.

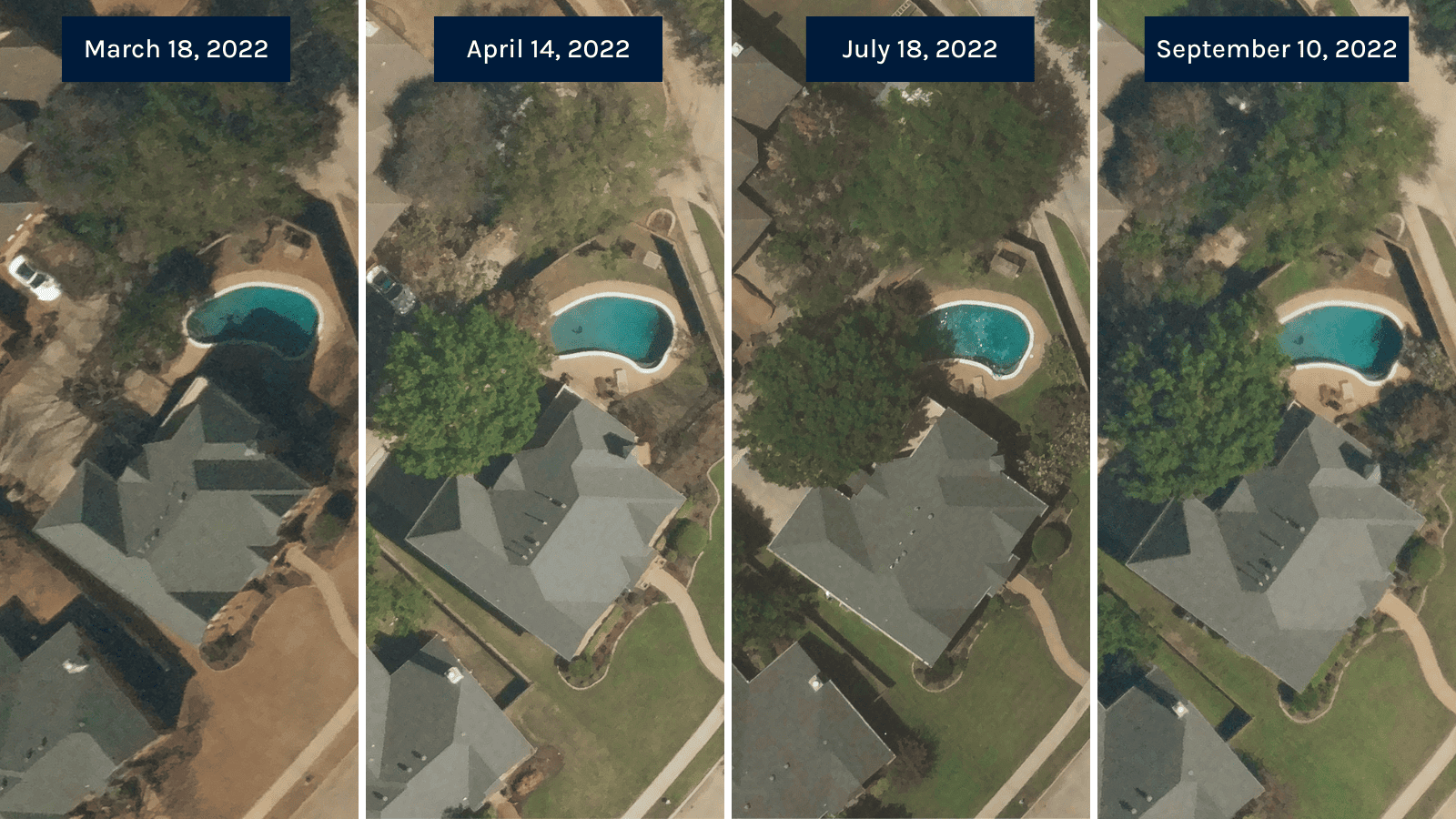

High-quality imagery means high enough resolution to see finite details of property conditions (we find 10 cm or better is necessary), frequent data refresh rates (four times a year) that allows insurers to identify changes and see how weather events affect areas amongst the different seasons, and wide geographic data coverage expanding urban, suburban, and rural areas so all communities receive the same quality attention.

Near Space Labs’ high-frequency imagery captures showing the state of a residential property and its surroundings throughout the seasons in Plano, Texas.

It’s also important to find sustainable solutions that don’t further intensify the climate problem. For example, Near Space Labs operates zero-emission stratospheric balloons to capture high-resolution, frequently updated imagery. Our vehicles don’t further pollute the planet we’re trying to protect, whilst providing timely insights about the built and natural environment.

Partnerships with sustainable data companies along with local governments, research institutions, and climate change focused organizations will help insurers gain a holistic view of the problem and allow them to put actionable measures in place to mitigate climate-related risks.

So where do we go from here?

For one, it starts with educating one another. As more businesses and consumers understand the importance of mitigating risks and taking preventive actions to foster resilience, the more likely they will be willing to adopt new technologies and embrace innovative practices.

The concept of an uninsurable world is tough to imagine, but it’s already happening in front of our eyes. By fostering collaboration among stakeholders, motivating consumers and businesses to take preventive actions, and prioritizing data-driven decision-making, we can enhance our resilience to climate disasters and protect our future.

If you’re a carrier looking for ways to mitigate risk, build resilience, and reduce future losses, sign up to talk to our team here.